When I was child, my parents bought me this big LEGO set for Christmas one year. As I was opening the package, hundreds of sports cards fell out.

Turns out someone was trying to rob the store and had removed all the LEGOs in order to stuff the entire inside with these cards. As a 6 year old, I was pretty upset about no LEGOs, but don’t worry, my parents did the right thing and returned the stolen goods. While 6 year old, hot wheel loving, train track building Mitch was excited to finally get his LEGOs in the return process, his 24 year old self would now greatly prefer the cards.

The more research I do on sports cards, the more I believe in the opportunity to make some serious cash. In the past, I thought of sports cards as something outdated, but after recently talking with a friend about the subject and conducting my own “due diligence,” I now see them as an incredible investment (if done correctly) for the following reasons:

- Nostalgia sells. 45 year old adults who grew up on the game of trading now have 7 and 11 year olds who they can pass the tradition onto. These same 45 year olds also now have substantial expendable income for the higher priced cards.

- Gambling is growing. I foresee a future where all 50 states will legalize sports betting, with the current market just in its infant stages. This gambling will trickle down from just betting on games to betting on paraphernalia as well.

- Supply and demand. The supply of cards has grown (cards have more volume than sneakers) but is still quite limited, with caps put in place to create rarity and display the uniqueness of each card. Basic economics shows us that anytime there are more buyers than sellers, unit prices will continue to be driven higher until an equilibrium is hit. I don’t think we are close to hitting that point yet.

- Personal Branding. We live in a world where we do not buy products, we buy into lifestyles. These lifestyles are personified by individuals. Lebron is synonymous with basketball, Messi with soccer, and Micky Mantle with baseball. By buying these cards, you are not just buying products, you are buying into these individuals, their legacy, and the lifestyle of being a sports fanatic.

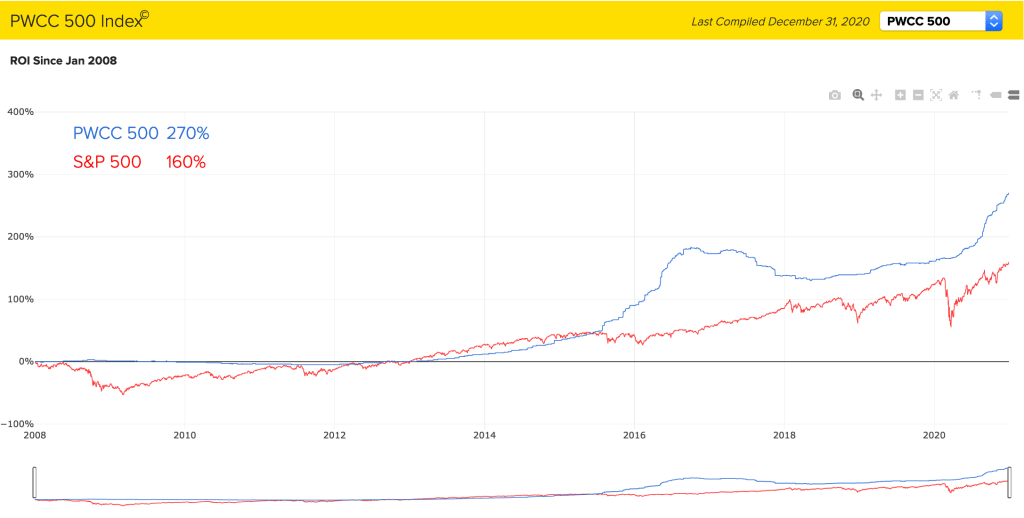

Need more convincing? Listed below are graphs from PWCC that show how the top 100 and 500 largest sports cards have tracked compared to the SP500 over the last 10 years. The returns are quite impressive:

So what does this mean for sports fans? Now, if you haven’t started already, is a great time to start collecting sports cards. Just make sure to do your research and ensure your cards are authenticated!

But what does this mean for the average, lazy investor such as myself?

If you are like me, you get extremely excited about new ways to make money, but also:

- Don’t want to spend hours researching individual rookie cards. You rather go snowboarding on the weekend.

- Don’t have 100’s of thousands of dollars or millions to invest in cards.

- Don’t want to physically hold onto these cards. While many others love showing off their 1952 Micky Mantle cards more than if they had the Mona Lisa in their basement, you want the freedom of having less possessions and being able to travel.

- Don’t want to gamble on individual cards, but bet on the overall market of sports cards for the next 10 years.

So how do you avoid all these things, while still not missing out on this expanding market?

My answer: Index funds for sports cards. Companies like PWCC are already tracking the highest priced cards. Certain VC firms are even raising money to buy various cards. Yet, unlike the stock market, there are no publicly available index funds that the average investor can place a small amount of money in or own fractional shares. A couple companies such as Rally Rd. and Otis are getting closer to this, but currently only have crowdfunding for individual cards. Unless you buy a bunch of these, you still do not have a diversified portfolio.

In summary, I believe that there is a large gap in the current marketplace to make sports cards an easy, diversified option for the laymen investor. Only time will tell if someone or some companies can rise to the occasion and provide this offering to the public. And if/when that happens, when the rain falls, will people put out their buckets to catch the water?